*Interview by José María Sánchez Galera. Published in Revista Centinela on 09/28/2022.

He has worked for financial firms such as Goldman Sachs, Citibank, and Merrill Lynch. He has studied at Harvard, the German School of Madrid, Université Paris Dauphine and ICADE. Before starting his working day, he practices sports with determination and has a good breakfast, because the day will always be demanding. He looks healthy, well-built and self-confident. So far, the typical portrait of the shark or wolf of Wall Street or the Ibex 35. But one day he began to feel that he needed to change his life.

He needed to reorient his life and help others to manage their money with the cunning of the serpent and the evangelical neatness of the birds that neither card nor spin. And, as he is a man who knows how to take advantage of that gold called time, during my delay he entered the church next to the cafeteria where we had arranged to meet.

He is Borja Barragan, founder of Altum Faithful Investing, a “financial advisory firm” dedicated – as it could not be otherwise – to generating succulent profits, but “applying Catholic principles in each and every one of the investment decisions”. He explains why someone with twenty years of experience in this sector embarks on this risk and dedicates himself to “faith-consistent investing”.

FOR ABOUT FIFTEEN YEARS, YOU HAVE HAD A TYPICAL CAREER IN PRIVATE BANKING AND INVESTMENT FIRMS.

Yes, in the sense of someone who is always involved in investment banking, especially in financial markets. That’s the image we might have in our heads: with six screens in front of us, buying and selling all day long. In fact, I was involved in interest rate and fixed income derivatives. Something a bit extraordinary, in the sense that, in the eyes of society, a young guy in investment banking is certainly not badly paid. Can you consider that there is something successful in that way of life? You scratch, and you see that it’s a bit of a fatuous success, a bit empty, a bit hollow.

WHY AN EMPTY SUCCESS?

Because you have to look for meaning and purpose in the things you are doing. In the end, when you work in investment banking, what drives you is – it sounds a bit harsh to say it – greed: I want more, more bonus this year, more bonus than last year, more bonus than my colleagues, or more bonus than what they can pay in other banks. And that’s when ethical dilemmas start to arise.

THIS WORLD IS THE ONE DEPICTED IN MOVIES LIKE MARGIN CALL (2011), THE WOLF OF WALL STREET (2013), OR THE MICHAEL DOUGLAS MOVIE, WALL STREET (1987), WHERE IT IS SAID: “MONEY NEVER SLEEPS”. ARE THEY CARICATURES, IS THERE TOO MUCH EXAGGERATION IN THESE FILMS?

The Wolf of Wall Street is a caricature. Although there may be some truth to it, especially on Wall Street, where Michael Douglas says: “Greed is good”. But those were other years. It was probably that way back then. The thing is that all that has evolved since then. What has been there, and that hasn’t changed, is what drives it, and that’s greed. You are worth what you are capable of generating solely and exclusively. Therefore, the person or the workers of this site become nothing more than capital. The moment they no longer generate profits, they are discarded, they are discarded.

IS THAT WHAT LEADS, IN MANY COMPANIES, TO COLD AUTOMATISMS AND EASY SOLUTIONS, SUCH AS FIRING PEOPLE, BASED ON WHAT AN EXCEL SHEET SAYS?

Correct. Man is a mere productive factor that can be dispensed with without any problem. He can be dispensed with and exploited. We only have to look at the schedules in which we work. The great majority of the people who work or who work in the service sector, above all, is a young married couple capable of raising a family in a solid way, of being able to raise a family, without worrying about how many children they are going to be able to have, just for economic reasons? This is a reflection that needs to be considered. If companies are, are we, promoting a society where human capital or productivity is more highly valued. Because there are certain things that are only generated in the family, such as trust, loyalty, honesty, a job well done, doing your duty. Basically, you learn that in your family, not at work. Now, employers do look for these kinds of qualities in employees. But, for that, you have to look for a culture of family generation. If there is something wrong in the business world, it is the lack of ethics, the lack of morality; what prevails is profit.

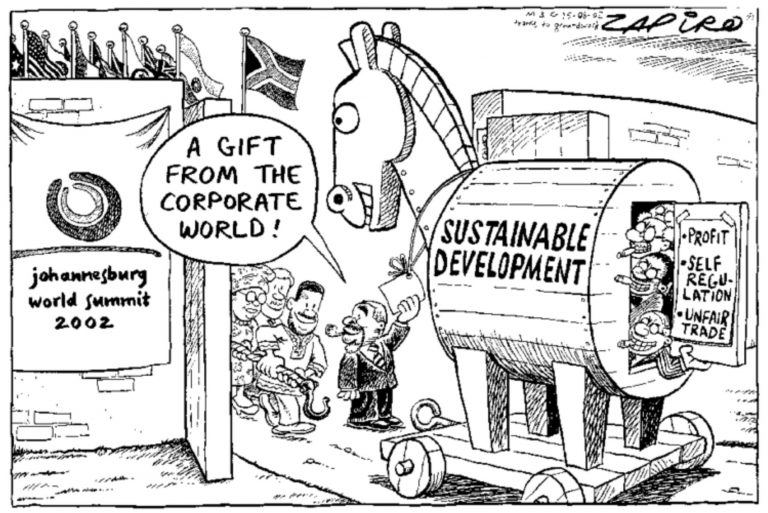

IN BUSINESS SCHOOLS, AND IN ALL CORPORATE COMMUNICATION TRENDS, THE IDEA IS BEING SOLD THAT COMPANIES ARE ETHICAL OR SUSTAINABLE. THEY ARE DIVERSE. THEY EVEN HAND OUT MORALIZING TO TELL US, THEIR CUSTOMERS AND CONSUMERS, HOW WE HAVE TO BE. IS THIS A REAL CHANGE OR IS IT JUST WINDOW DRESSING?

We are allowing companies to dictate moral criteria. When a company should be a place that provides a product or a service in the most efficient way possible, and for the common good of society, and that generates jobs. The problem is when companies are getting out of the pot and getting into not only economic, but also political, and even moral and religious views. That is where we, the users or investors, the consumers, have to stop for a second and ask ourselves: “What kind of companies am I investing in? What kind of companies am I consuming from?

FACED WITH THIS CONTEXT, YOU DECIDE TO CHANGE. IS IT AN OVERNIGHT CHANGE, OR IS IT A PROCESS?

It was a process. I began to study for a master’s degree in Family Ministry at the John Paul II Institute. There I understood two things very clearly. First, I discovered my vocation to marriage and how I wanted to live my marriage, and what kind of time and space I should dedicate to my marriage. This is the personal aspect, but it was a turning point that conditioned everything else. Secondly, it so happened that among the students in that master’s program there were religious men and women who, when they found out that I was involved in finance and investments, asked me: “Hey, this is our investment portfolio, we are investing in this, we don’t feel comfortable”. That’s where I see two problems happening. First, the very high commissions that these religious people were paying, mainly due to their ignorance. They had no way of controlling the commissions they were paying. Second, the lack of consistency between their investment portfolios and the faith professed by that entity itself. An example: you can be investing in companies that promote abortion, in companies that are manufacturing the morning-after pill, companies that are radically and unconditionally supporting gender ideology, religious persecution.

RELIGIOUS PERSECUTION?

There are cases, especially in the United States. There are companies that are supporting what is called the Equality Act. It is a law under which you cannot conscientiously object to certain types of things. In the state of New York, if a doctor objects in conscience when performing an abortion, he can get a huge fine. And there are companies that promote this. That’s where we have to stop the machines a little bit and ask ourselves what power we are giving to companies.

AND THAT IS WHAT YOU DETECT, AS A RESULT OF THAT MASTER’S DEGREE IN FAMILY PASTORAL CARE.

As a result of this, I realized that I am good at investments and finances. And I ask myself how I can put it at the service of institutions that have been accompanying me personally throughout my life. One of the morals I have learned is that I want a unity of life; it cannot be that from Monday to Friday I am swimming among sharks, and then on Sundays I am a family man involved in parishes and catechesis. It is incongruous.

IN SPAIN, LEADING COMPANIES AND BANKS, DURING THE WEEKS OF JUNE OR JULY, PLACE THE LGTB FLAG IN THE CORPORATE LOGO. AND THEN WE FIND OUT THAT THEIR TOP MANAGER WHO, IN ONE WAY OR ANOTHER, TOLERATES THIS MOVEMENT GOES TO MASS EVERY DAY OR BOASTS OF HAVING A PRACTICING CATHOLIC FAMILY.

It is something that we do not know if it is here to stay, or if it is just a fad. It is curious that many of these companies that change the logo during certain months, clearly supporting the gender ideology, are companies that do not stop selling a single phone, nor a single good or service, in countries where homosexual people are really punished, such as in countries like Iran. In these cases, companies are using people for purely commercial and marketing purposes. The dignity of the person is not being preserved; the person is being used as a mere productive factor.

COMPANIES SEEM TO REPLACE CHURCHES AS MORAL REFERENCES. HOWEVER, YOU START PROVIDING FINANCIAL SERVICES FOR RELIGIOUS ENTITIES, AND YOU STOP WORKING FOR OTHER CORPORATE CLIENTS. IS PART OF YOUR BUSINESS AT ALTUM.

If we are going to offer a financial service, the first thing we must do is to be very good financial professionals. The first thought on my part was: “Light and stenographers” and to be regulated by the CNMV to offer a guarantee that things are being done as they should be done. From that point on, two main activities begin at Altum. The first is investment advice, in which we develop investment recommendations that never conflict with the Catholic magisterium. The Catholic magisterium is very rich, but there is no doctrinal document that tells you how a Catholic should invest. The Church is there to offer a series of guidelines, but not to provide technical solutions. Therefore, what we have done has been to try to ground all this doctrine and apply it in a pragmatic way in how to build an investment portfolio, based on four pillars: promotion of life, promotion of the family, human dignity and protection of Creation. These four pillars are, in a way, the legacy of the last three popes: life and family, John Paul II; human dignity, Benedict XVI; care and protection of Creation, Pope Francis.

HOW DO YOU UNDERSTAND THIS LAST POINT?

As it should be understood: without idolizing the environment, and with a correct use that man should make of the environment. And watching over that which is in the Social Doctrine of the Church, which is the integral development of the person, and always watching over the generations to come. But in no case comparing the otter cub with the human fetus. And this is something that Pope Francis denounces in Laudato Si’. He says that it is an absolute incongruity that we want to defend the environment without defending the most defenseless of humans, which are the fetuses.

HOW DOES THIS MATERIALIZE, FOR YOUR CUSTOMERS AND FOR EVERYONE?

Analyzing so many companies, from the point of view of the Catholic magisterium, we find a huge database of information. This database is very useful for the professional client, for management companies and banks that want to create portfolios in a way that is coherent with the Catholic magisterium. And we have a problem, and that is that there are eight of us in the Altum FI team. People from the retail world call us and ask us: “Listen, I have small assets, and I would like you to manage them in this way, because I believe in the criteria you are applying”. But we don’t have enough hands or time to manage 20,000 assets of 4,000 euros. It makes us very angry -because Catholic means universal- that the management coherent with the faith -the faithful investing- to be only for the rich, or for congregations, or for family offices that have people with money. From here the bet was to say: “Let’s make it accessible to everyone”. That is the raison d’être of the Altum App. Thanks to this application -for mobile or web-, anyone, before making an investment decision, can check whether or not this or that company is in conflict with the Catholic magisterium.

IS INFORMATION THAT IS GIVEN. IT IS NOT A SERVICE FOR WHICH YOU CHARGE.

We don’t charge, it’s free. But because we want there to be no hindrance, if someone wants to invest in a way that is consistent with their faith. What we want is that those who make money by investing, that is, the mutual funds in which you and I can invest, pay for this service. If you are a mutual fund manager, and if there are clients of yours who want to invest in a faith-consistent way, you buy that platform. This platform is called Altum Explorer, and on it you can build coherent portfolios, but you are the one who pays for it.

ARE ALTUM’S CLIENTS RELIGIOUS ASSOCIATIONS…?

Religious institutions, foundations, bishops’ conferences, both in Spain, Portugal and Italy. And we also have private clients who like the approach we take, but because at the end of the day they are people who are looking for a unity of life. And family offices, for example. We have specific cases of people who are not religious, but who want to live in coherence.

WHY DO YOU CHOOSE THE NAME ALTUM?

The name comes from “Duc in altum”, from Luke 5:4, “Put out into the deep”. The apostles are on the shore, lethargic, sad, cleaning their nets, empty because they had caught nothing the night before. The Lord comes and says to them, “Put out into the deep; Peter, get into the boat and let down the net. And he will pull it out full of fish. But this is not about the fact that, if you invest in faith, you will have much more profitability. No. What this is about is encouraging those apostles who were standing on the shore, lethargic and sad, doing nothing, to go a step further and dare to be consistent in their way of investing. This is an appeal to Christians: now it is possible. There is an alternative. We have come from an era of conventional investment whose objective was to maximize profit. In the last seven or ten years, we have had socially responsible investment, sustainable investment. The next step is morally responsible investment.

WHY THE DIFFERENCE BETWEEN “SOCIALLY RESPONSIBLE” AND “MORALLY RESPONSIBLE”?

Because we cannot fall into the trap of there being companies that, from the ESG (Environmental, Social, Governance) point of view, may have a very good rating, because they have no toxic emissions, from the governance point of view they behave phenomenally with all their employees, and all the stakeholders are delighted with them. But, if this company engages in human embryo research, for the Christian, for the Catholic, a red flag should be raised. That’s where we come in, and that’s where the concept of faithful investing comes in. That’s what Altum’s name is: put out to sea, leave behind the clings of the past and the old securities, and dare to invest in a coherent way.

DID THIS “GOING INTO THE DEEP SEA” GIVE YOU VERTIGO? YOU WERE LEAVING A SECURE JOB.

At that time I had four children; now I have seven. It was a radical change, but it was also a process of more than six months of talking it over with my wife. It was a process of asking myself: How can I put those gifts that God has given me at the service of others? It was a long process, and also spending a lot of time in front of the Blessed Sacrament. Important decisions in life are sometimes simmering. They are not quick and fleeting decisions. I believe that today’s man, the postmodern man, has a big problem, and that is that he has taken God out of his life. We have taken God out of all our decisions.

DO YOU THINK IT WOULD BE PREFERABLE TO ATTEND FEWER BUSINESS SCHOOLS AND LEARN MORE ABOUT THE SOCIAL DOCTRINE OF THE CHURCH?

You touched on a very important point. We recently put out a faith consistent investing report in which we compared ESG versus faithful investing. The moral is that ESG has many weaknesses. Because some use one methodology to measure CO2 emissions, and others use another. How is it possible that Tesla, for one ESG measurement company, has a very good rating, and for another it has a very bad rating? It is incongruous and very unsound. Do you know which criteria have remained unchanged over time, and which are always and everywhere applicable for the integral development of the person? The Church’s statements of faith.