Faith based investing, also known as faithful investing or ethical investing, is an approach to managing financial assets that align with the principles and beliefs of religious or ethical doctrines. It involves integrating one’s faith or moral convictions into investment decisions, seeking to generate financial returns while adhering to certain ethical, social, or religious guidelines. These guidelines may vary depending on the specific faith tradition or ethical framework of the investor.

Brief Overview of the Concept

Faith based investing is rooted in the belief that financial decisions should reflect one’s values and principles. It is a conscious effort to invest in companies or projects that contribute positively to society while avoiding those that conflict with moral or ethical standards. This approach considers not only the financial aspects of investments but also their social and environmental impact.

Although non-financial factors such as environmental, social, and governance (ESG) sustainability have become an important part of investor analysis, this approach alone is insufficient for many investors, as it does not incorporate other important concerns and beliefs. Faith based investing goes further by integrating religious principles into investment strategies. Investors who subscribe to this approach typically screen potential investments based on criteria that reflect their values. One of the primary objectives is to promote social responsibility and ethical behavior within the corporate world.

For example, a Christian investor might choose to avoid investing in companies involved in activities such as abortion, pornography, or weapons manufacturing, as these industries may conflict with Christian teachings. Similarly, an Islamic investor may adhere to Shariah principles, which prohibit involvement in businesses related to alcohol, pork, gambling, or interest-based financing.

In addition to avoiding certain industries or practices, faith based investors may actively seek out opportunities that align with their values. This could involve investing in companies that demonstrate a commitment to environmental sustainability, promote social justice, or support community development initiatives.

The concept of faith based investing is not limited to individual investors; institutional investors, including religious organizations, endowments, and foundations, also incorporate ethical considerations into their investment strategies. These entities often use their financial influence to advocate for positive change and hold companies accountable for their actions.

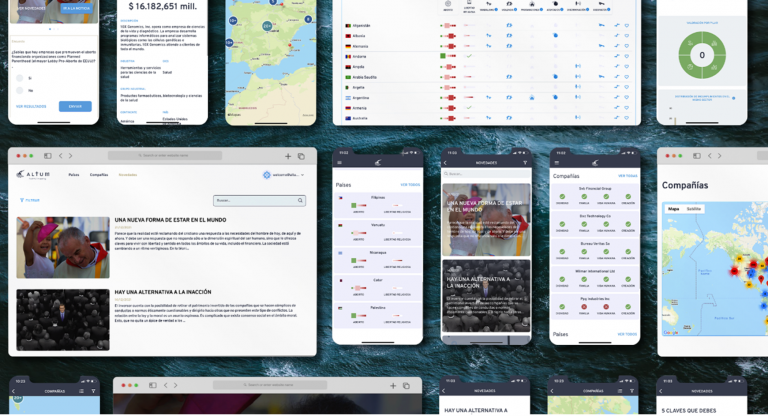

However, faith-based investing is not without its challenges. Balancing financial returns with ethical considerations can sometimes be complex but, contrary to popular belief, incorporating moral criteria into investment decisions does not necessarily lead to lower returns. Both in Spain and Europe as well as in the United States, the application of faithful investing criteria allows not only to achieve higher returns in a sustained and persistent manner over time but also provides perfectly diversified investment portfolios, being able to have a presence in every one of the productive sectors according to the GICs classification.

Despite these challenges, faith based investing offers investors an opportunity to align their financial goals with their moral and ethical beliefs. By investing in companies that reflect their values, individuals, and institutions can contribute to positive social change while potentially achieving attractive returns on their investments. As awareness of the interconnectedness between finance and values continues to grow, faith based investing will remain a significant force in the world of finance.